PCI DSS vs Cyber Essentials – Key Differences for UK SMEs

- Gary Sinnott

- Dec 14, 2025

- 7 min read

Every British business managing digital transactions faces tough choices about cybersecurity. With cyber attacks costing UK firms an average of £4,200 per breach, selecting the right protection measures becomes critical. Understanding the differences between PCI DSS and Cyber Essentials helps organisations balance regulatory demands, technical requirements, and practical costs. This guide breaks down the strengths, limitations, and key considerations for each framework, helping British companies make informed decisions about digital security.

Table of Contents

Key Takeaways

Point | Details |

PCI DSS is mandatory for certain businesses | Organisations that process payment card data must comply with PCI DSS to protect cardholder information and avoid severe penalties. |

Cyber Essentials provides a baseline for cybersecurity | This UK government-backed certification focuses on fundamental practices that can mitigate common cyber threats across various sectors. |

Compliance costs vary significantly | Achieving Cyber Essentials typically costs £300 to £1,500, while PCI DSS compliance may incur substantial penalties and ongoing operational costs. |

Understanding your business needs is crucial | Businesses should assess their specific requirements to choose the appropriate framework, balancing between Cyber Essentials for general security and PCI DSS for payment protection. |

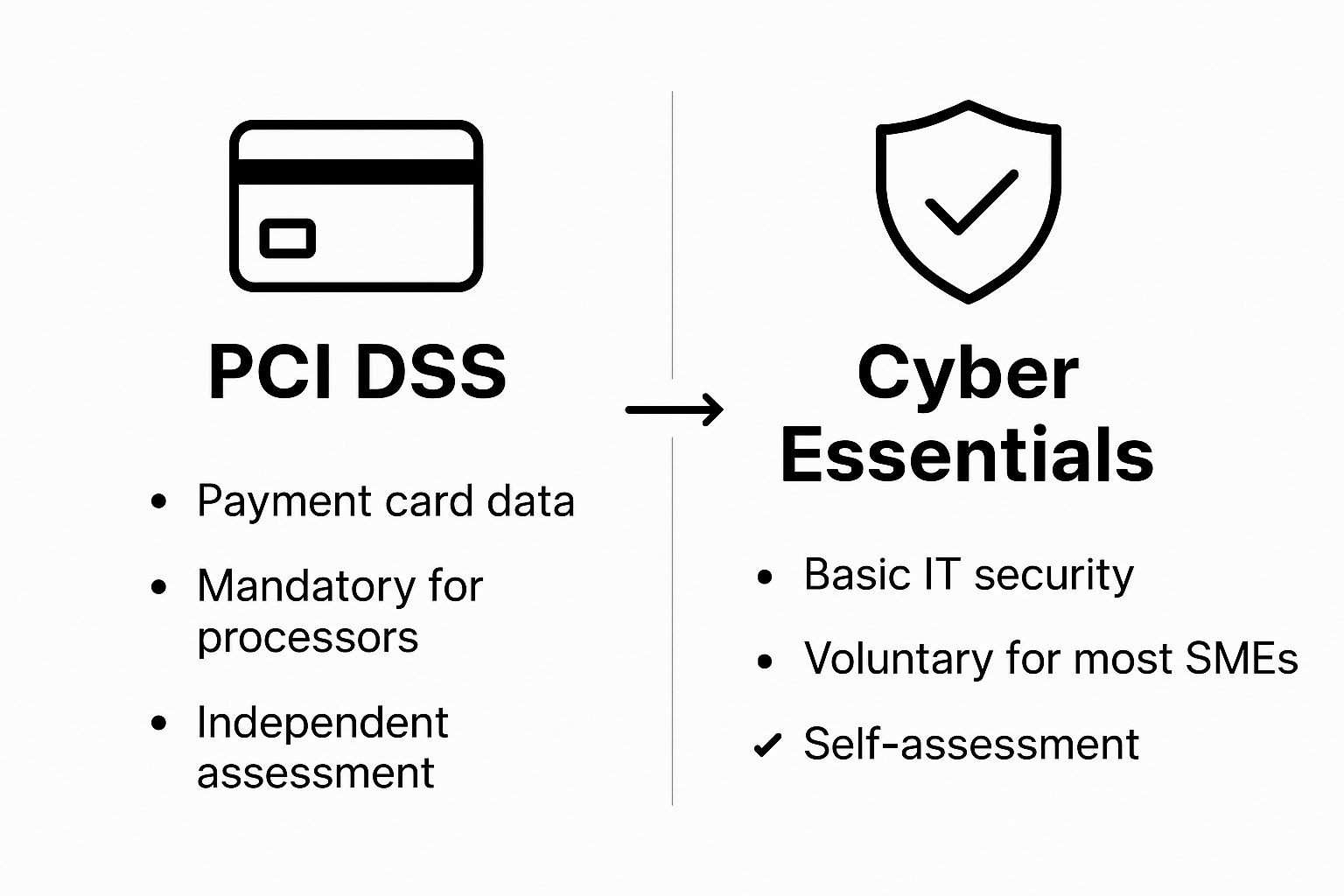

PCI DSS and Cyber Essentials Defined

Understanding the key cybersecurity frameworks is critical for UK small and medium enterprises navigating digital protection strategies. Two prominent standards - PCI DSS and Cyber Essentials - offer structured approaches to managing digital security risks, though they serve distinctly different purposes and scopes.

The Payment Card Industry Data Security Standard (PCI DSS) represents a comprehensive security protocol specifically designed for organisations handling payment card information. Created by the Payment Card Industry Security Standards Council, this standard aims to prevent payment card fraud by establishing rigorous controls around cardholder data protection. Businesses processing credit card transactions must implement multiple technical and operational safeguards to achieve and maintain compliance, with requirements that can feel complex and demanding for smaller organisations.

Cyber Essentials, by contrast, is a UK government-backed certification focused on fundamental cybersecurity practices. Overseen by the National Cyber Security Centre, this framework provides a streamlined approach to digital defence, concentrating on five core technical controls that can mitigate approximately 80% of common cyber threats. These controls address critical vulnerabilities such as:

Boundary firewalls and internet gateways

Secure configuration of devices and systems

User access control and account management

Malware protection

Patch management strategies

While PCI DSS targets specific financial transaction security, Cyber Essentials offers a broader, more accessible baseline of cybersecurity protection suitable for businesses across various sectors. The key distinction lies in their scope: PCI DSS is mandatory for organisations processing payment cards, whereas Cyber Essentials provides a voluntary but increasingly essential certification for demonstrating basic cyber hygiene.

Scope and Applicability for UK Businesses

Navigating the landscape of cybersecurity standards requires UK businesses to understand the precise applicability of frameworks like PCI DSS and Cyber Essentials. While both aim to strengthen organisational digital defences, their scope and mandatory requirements differ significantly across various business sectors.

The Cyber Essentials scheme is designed to provide a universal baseline of cybersecurity protection for organisations of all sizes. This UK government-backed programme recognises that businesses across different industries face similar fundamental digital threats, offering a standardised approach to mitigating common cyber risks. Whether you’re a small retail shop, a professional services firm, or a tech startup, the scheme provides a consistent framework for improving basic digital security practices.

In contrast, PCI DSS has a much more targeted and mandatory application. PCI DSS compliance applies specifically to organisations that handle, process, or transmit cardholder information. This means the standard directly impacts businesses such as:

Retail establishments with point-of-sale systems

E-commerce platforms processing online payments

Financial service providers

Hospitality businesses handling customer card transactions

Payment gateways and merchant service providers

The critical difference lies in enforceability. While Cyber Essentials offers a voluntary certification that demonstrates good cybersecurity hygiene, PCI DSS compliance is mandatory for any organisation processing payment card data. Non-compliance can result in significant financial penalties, potential loss of merchant services, and increased vulnerability to data breaches. For UK SMEs in sectors handling financial transactions, understanding and implementing these standards isn’t just recommended - it’s a critical business necessity.

Core Requirements and Assessment Processes

Effective cybersecurity standards demand rigorous assessment processes to ensure organisations genuinely protect their digital infrastructure. The approaches taken by Cyber Essentials and PCI DSS reflect their distinct objectives, with each framework employing unique methodologies for verification and compliance.

Cyber Essentials focuses on five fundamental technical controls that form the backbone of its certification process. These critical controls include:

Secure configuration of devices and systems

Boundary firewalls and internet gateways

User access control mechanisms

Malware protection strategies

Security update and patch management

The certification process for Cyber Essentials involves a self-assessment questionnaire that businesses complete, which is then reviewed by an accredited assessor. Companies have two primary certification paths: the standard Cyber Essentials certification, which relies on the self-assessment, and the more comprehensive Cyber Essentials Plus, which requires an independent technical audit with hands-on vulnerability testing.

PCI DSS compliance, by contrast, demands a more comprehensive set of security standards that organisations must meticulously implement and document. The assessment process is significantly more complex, requiring businesses to demonstrate:

Robust network security infrastructure

Comprehensive cardholder data protection measures

Active vulnerability management programmes

Stringent access control protocols

Continuous network monitoring and testing

Formal information security policy documentation

Unlike Cyber Essentials, PCI DSS assessments are typically conducted by qualified independent security assessors who perform exhaustive reviews, on-site inspections, and detailed vulnerability scanning. The stakes are high - non-compliance can result in substantial financial penalties, potential service disruptions, and increased cybersecurity risks.

Compliance Costs, Risks, and Penalties

Navigating the financial implications of cybersecurity standards can be complex for UK small and medium enterprises, with each framework presenting unique cost considerations and potential risks. Understanding the economic landscape of Cyber Essentials and PCI DSS is crucial for making informed strategic decisions about digital security investments.

Cyber Essentials certification can lead to tangible financial benefits, including reduced insurance premiums and enhanced organisational credibility. The costs associated with achieving certification are relatively modest, typically ranging from £300 to £1,500 depending on the organisation’s size and complexity. Most businesses find the investment worthwhile, as the certification demonstrates a proactive approach to cybersecurity and can provide a competitive edge in tender processes and client negotiations.

In contrast, PCI DSS compliance carries substantially higher financial stakes. Failure to comply with payment card security requirements can result in severe penalties, including:

Monthly fines between £5,000 and £100,000 from payment card providers

Potential loss of ability to process card payments

Significant reputational damage

Direct financial losses from potential data breaches

Increased insurance premiums

Legal costs associated with potential litigation

The financial implications extend beyond immediate penalties. Non-compliance can trigger a cascade of economic consequences that might permanently damage a business’s financial stability and market reputation. While Cyber Essentials provides a preventative framework with manageable costs, PCI DSS represents a more rigorous and financially consequential standard that demands continuous investment in robust security infrastructure and ongoing compliance monitoring.

Choosing the Right Standard for Your Business

Selecting the appropriate cybersecurity standard is not a one-size-fits-all decision. UK businesses must carefully evaluate their specific operational requirements, digital infrastructure, and regulatory obligations to determine whether Cyber Essentials or PCI DSS represents the most suitable framework for their unique context.

For UK SMEs handling digital assets or storing data, Cyber Essentials provides an accessible entry point into structured cybersecurity practices. This framework is particularly beneficial for organisations seeking to:

Establish a foundational security baseline

Demonstrate commitment to digital protection

Enhance organisational cyber resilience

Improve tender and contract eligibility

Reduce basic cybersecurity vulnerabilities

Build customer and partner trust

Conversely, PCI DSS becomes mandatory when organisations process, store, or transmit cardholder data. Businesses operating in the following sectors should prioritise PCI DSS compliance:

E-commerce platforms

Retail establishments

Financial service providers

Payment gateway operators

Online transaction processors

Hospitality and tourism businesses

The decision ultimately depends on your specific business model, transaction types, and risk profile. While Cyber Essentials offers a broad, accessible approach to cybersecurity, PCI DSS provides a comprehensive, rigorous standard specifically designed for financial transaction protection. Smart businesses often implement both frameworks, using Cyber Essentials as a foundational layer and PCI DSS for targeted payment security, creating a multi-layered defence strategy that comprehensively protects digital assets and customer information.

Simplify Cybersecurity Compliance for Your UK SME Today

Navigating the complex requirements of PCI DSS and Cyber Essentials can be overwhelming, especially for busy business owners and lean IT teams. The challenge lies in balancing mandatory compliance with practical cybersecurity controls while avoiding costly penalties or vulnerabilities. Whether you need to establish a strong foundational defence under Cyber Essentials or maintain continuous protection aligned with PCI DSS, having the right expert support makes all the difference.

Take control of your cybersecurity journey with Freshcyber. Our tailored services ensure stress-free certification and ongoing vulnerability management so you never worry about audits or compliance gaps again. Start protecting your business and boosting client confidence now by exploring our comprehensive Compliance solutions or learn how continuous Vulnerability Management can help ensure compliance with PCI DSS and keep your defences strong year-round. Visit Freshcyber and secure your peace of mind today.

Frequently Asked Questions

What is the main purpose of PCI DSS?

PCI DSS is designed to protect payment card information by implementing stringent security controls for organisations that handle cardholder data.

How does Cyber Essentials differ from PCI DSS?

While Cyber Essentials focuses on basic cybersecurity practices applicable to all businesses, PCI DSS specifically targets organisations that process payment card transactions and includes more comprehensive compliance requirements.

What are the key controls included in Cyber Essentials?

Cyber Essentials outlines five core controls: boundary firewalls and internet gateways, secure configuration, user access control, malware protection, and patch management strategies.

Is PCI DSS compliance mandatory for all businesses?

No, PCI DSS compliance is only mandatory for organisations that process, store, or transmit payment card data, whereas Cyber Essentials is a voluntary certification applicable to businesses of all sizes.

Recommended